The Baltic Exchange: Bulk report – Week 31

The Baltic Exchange: Bulk report – Week 31

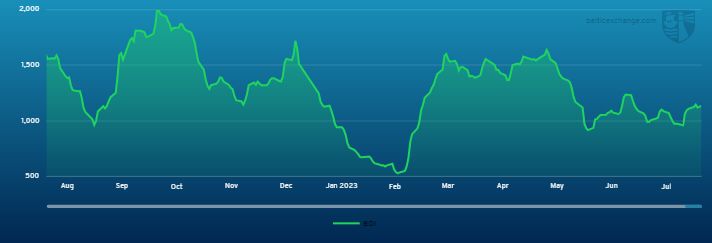

Capesize

The cape market had a sluggish start to the week but gradually exhibited signs of improvement and positivity as the week progressed. The anticipated momentum in the Pacific fizzled out by the middle of the week despite the presence of two of the major players. However, there was an uptick in coal enquiry that boosted owners’ confidence amid a sense of resistance and rates nudged back up towards the end of the week. In the Atlantic more favourable bids were being discussed from South Brazil and West Africa to China in the early part of the week. However, some owners chose to be cautious, resulting in slightly subdued conditions early on. By the middle of the week there was a notable uptick in activity, with several fixtures being concluded at rates slightly surpassing the C3 index on that day. The North Atlantic provided substantial market support last week, but so far this week, the cargo flow has not matched previous levels. As the week draws to a close there are encouraging reports of a robust fronthaul fixture from West Africa to China being concluded, leaving a positive impression to conclude the week.

Panamax

The week returned a whirlwind of activity for the market with solid activity both in the North Atlantic round trips, as well as from Indonesia and to a lesser extent ex Australia in the Pacific basin. The strong pace did appear to ease back as the weekend approached with rates stalling but the fundamentals in the Atlantic continue to lend support. In the Atlantic a scrubber fitted 81,000-dwt delivery Continent was heard fixed mid-week for a trip via US East Coast redelivery Continent at $12,000 with the scrubber benefit going to charterers. Despite limited activity, firmer rates were paid for NoPac round trips on decent type tonnage on favourable deliveries, but the market remains underwhelming with the P3a average hovering around the $7,000 mark. Period bids and offers continued to be far reaching with little concluded. However, an improved rate of $12,000 was paid for an 81,000-dwt delivery China for 6/8 months period.

Ultramax/Supramax

A rather mixed week overall for the sector with sentiment still at a low ebb. However, the Atlantic saw some positional opportunities from key areas such as the US Gulf. The South Atlantic saw divided opinion with some stronger rates being achieved. From Asia, the south saw very limited activity and the prompt tonnage count increasing. Further north, some said that signals were a little more encouraging, with better demand for backhaul requirements. On the period front, a good described 63,000-dwt was fixed delivery Philippines for 3 to 5 months trading at $14,000, whilst a eco 55,000-dwt was rumoured to have been fixed basis delivery China for two years at 110% of the BSI. In the Atlantic, a 56,000-dwt was heard fixed delivery EC South America for a trans-Atlantic run at $14,000. A 56,000-dwt fixed delivery US Gulf trip to SE Asia in the low $11,000s. From Asia, a 63,000-dwt fixed a trip delivery China via Indonesia redelivery North Continent at $8,000. A 53,000-dwt fixed delivery Koh Si Chang trip via Indonesia redelivery China at $7,000.

Handysize

Brokers spoke of a relatively inactive week across the handy sector but some felt parts of the Atlantic might have found the bottom albeit on a temporary basis. An unnamed vessel was rumoured to have been fixed basis delivery Iskenderun for a trip to North Coast South America-Caribbean range in the mid $7,000s and a 33,000-dwt fixed from Morocco to the Continent at $5,000. A 37,000-dwt was fixed from South Africa to Singapore-Japan range at $9,000. In Asia, there was more reported activity with a 37,000-dwt fixing with prompt dates from Thailand via Australia to China with an intended cargo of spodumene at $7,000. A 37,000-dwt opening in Port Kembla was fixed via Eastern Australia to Singapore-Japan range with an intended cargo of concentrates at $9,250. Period interest from charterers had remained and a newbuild 40,000-dwt was rumoured to have been fixed ex-yard in October for two years period at $14,200.